The Price of Oil: why it rose stupendously, why it is likely to remain low and what this means for the world

Although oil has experienced an extraordinary price increase over the past few decades, a turning point has now been reached where scarcity, uncertain supply and high prices will be replaced by abundance, undisturbed availability and suppressed price levels in the decades to come, write Roberto F. Aguilera of Curtin University in Australia and Marian Radetzki of Luleå University of Technology in Sweden. In this article they provide a synopsis of their new book, The Price of Oil, which is to be published by Cambridge University Press in October 2015. They explain why we are in a new oil price world and examine the implications of this turnaround for the world economy, as well as for politics, diplomacy, military interventions and the efforts to stabilize climate.

Although oil has experienced an extraordinary price increase over the past few decades, a turning point has now been reached where scarcity, uncertain supply and high prices will be replaced by abundance, undisturbed availability and suppressed price levels in the decades to come, write Roberto F. Aguilera of Curtin University in Australia and Marian Radetzki of Luleå University of Technology in Sweden. In this article they provide a synopsis of their new book, The Price of Oil, which is to be published by Cambridge University Press in October 2015. They explain why we are in a new oil price world and examine the implications of this turnaround for the world economy, as well as for politics, diplomacy, military interventions and the efforts to stabilize climate.

Part I. Oil’s extraordinary price history: how can it be explained?

Oil price developments over the past 40 years have been truly spectacular. In constant money, prices rose by almost 900% between 1970-72 and 2011-13 (Figure 1). This can be compared with a 68% real increase for a metals and minerals price index, comprising a commodity group which like oil belongs to the exhaustible category. The objective of this part is to explain the price exceptionality of oil.

We do not share the widespread opinion, held by a majority of market specialists, that OPEC’s interventions since the early 1970s have had a major influence on the price behavior of oil. While OPEC cooperation has undoubtedly had short term impacts on the oil market, its interventions are completely inadequate for explaining the longer run price performance. Underlying our position is a number of academic studies pointing to the short run and insubstantial nature of the oil group’s supply-restraining actions. However, it needs mentioning that actions of Saudi Arabia in isolation to limit output, and even more, the country’s cautious approach to capacity expansion, have clearly contributed to the oil price evolution.

In our view, a number of political rather than economic forces have shaped the inadequate growth of upstream production capacity, the dominant factor behind the long run upward price push. This is particularly, but not exclusively, true in OPEC, the country group with a leading share of global oil reserves.

Widespread nationalizations of the oil sector in the 1970s replaced private multinationals with state owned enterprises. The latter did not invest much in capacity expansion because of a persevering lack of technical proficiency in many cases and a tendency of their government owners to use the surpluses generated by oil production in support of the state budget, so leaving insufficient resources for investment. A variety of goals apart from profit were often imposed on the state owned firms, resulting in high costs and inefficiencies that further reduced investments in new capacity.

Private multinationals had been deprived of a sizable proportion of conventional oil reserves in the nationalization wave, so they could not easily compensate for the state owned deficiencies in capacity expansion. Furthermore, as prices and profits rose in consequence of rising demand and stagnant production capacity, virtually all producing governments, inside and outside OPEC, sharply raised taxes and other impositions, further reducing the willingness to invest. In this way, a vicious circle was put in place, and its operation was made viable by the very low price elasticity of demand (i.e. unresponsive demand to even significant price changes) in the short- and medium-term.

While some believe that depletion and thus rising costs can explain price developments, the continuous rise of global oil reserves along with the high level of pre-tax profits in the industry are clear indicators that depletion has not been a factor behind the observed oil price evolution.

Another related revolution is beginning to see the light of the day, but news about it has barely reached the media

The resource curse, represented by domestic and international conflicts over the oil rent, is probably the most important explanation to the extraordinary oil price developments. We have looked at only six countries – Iran, Iraq, Libya, Nigeria, Sudan and Venezuela, all richly endowed with oil resources – to conclude that the resource curse had suppressed their recent production levels below peaks attained decades ago by a total of 7 million barrels per day, corresponding to no less than 55% of overall annual oil consumption in the European Union. In the absence of such suppression, oil prices would clearly have been far below the heights seen between the end of 2010 and autumn 2014.

Part II. The shale and conventional oil revolutions: low prices ahead

The shale oil revolution has unexpectedly and forcefully begun to transform the energy landscape in the United States. Beginning less than ten years ago, the revolution – employing technological innovations in horizontal drilling and hydraulic fracturing – has turned the long run declining oil production trends in the US into rises of 73% between 2008 and 2014 (Figure 2). The shale oil costs become broadly competitive at oil prices of $50 per barrel, lower than the costs of Canadian oil sands and Brazilian deep offshore pre-salts. An exceedingly high rate of productivity improvements in this relatively new industry promises to strengthen the competitiveness of shale output even further. The revolution has had a number of positive effects for the US economy in terms of, for example, investments, employment, fiscal revenue and a strengthening trade balance.

The US lead in the shale revolution has many explanations, including large-scale and long-lasting conventional oil exploitation, a well-developed fossil fuel infrastructure, established production of inputs, many small adventurous prospecting and production enterprises, a relatively sympathetic public approach to the new industry, and the incentive to the landholder of underground resources ownership.

A series of environmental problems related to shale exploitation have been identified, most of which are likely to be successfully handled as the infant, “wild west” industry matures and as environmental regulation is introduced and sharpened.

We firmly believe that the combined impact of the two revolutions will have an overwhelming impact on oil, by far the economically most important primary commodity in human use

Geologically, the US does not stand out in terms of shale resources. A very incomplete global mapping suggests a US shale oil share of no more than 17% of a huge geological wealth widely geographically spread, with lead positions held by countries like Argentina, Australia, Mexico, China, Libya and Russia. Given the mainly non-proprietary shale technology and the many advantages accruing to the producing nations, it is inevitable that the revolution will spread beyond the US.

We have assessed the prospects of non-US shale oil output in 2035, positing that the rest of the world will by then exploit its shale resources as successfully as the US has done in the revolution’s first ten years – implying that the global revolution will occur with a substantial delay and at a much slower pace than the one achieved by the US. With roughly a 17% share of global shale resources, the US in 10 years expanded its output by 3.9 mbd. Assume, then, that the rest of the world is equally as successful as the US was between 2004-2014 in exploiting its share of the resources between 2015-2035. This would yield rest of world output of 19.5 mbd in 2035 (Table 1), which is similar to the global rise of all oil production in the preceding twenty years – a stunning deduction with far-reaching implications in many fields.

Another related revolution is beginning to see the light of the day, but news about it has barely reached the media. It is being gradually realized that the advancements in horizontal drilling and fracking can also be applied to traditional oil extraction, thereby substantially improving the productivity of conventional, mature and declining oilfields worldwide. This is yet another method to achieve enhanced recovery, in addition to the usual enhanced oil recovery technologies involving the injection of steam, chemicals or gas into formations. Several basins in the United States and other countries are already experiencing this new phenomenon, which we call the conventional oil revolution.

In a similar fashion to the output projections for shale oil, we assume that conventional oil in the rest of the world is able to benefit from the application of shale oil extraction methods just as US conventional oil did. Since 2008, the shale technologies have led to a US conventional oil rise of around 0.5 mbd. Imagine now that the ROW is correspondingly successful by 2035 in applying the related technologies to its share of conventional oil reserves as the US has been until now. This would yield a further addition of conventional oil amounting to 19.7 mbd by 2035 (Table 2).

The combination of the two revolutions sum up to a spectacular total output rise of 39 mbd. This equals almost half of global oil output in 2014, is nearly twice as much as the global increase in all oil production in the 20-year period 1994–2014, and is close to one-third greater than OPEC’s output in 2014.

The pace of the shale and conventional oil revolutions is likely to be slowed somewhat if the price levels observed in the first half of 2015, averaging some $57 per barrel (Brent spot), persevere for several years, and the ultimate price fall caused by the revolutions will be less dramatic. In a five year time perspective, we believe there is a likelihood that prices will recover a bit from the 2015 quotes, pending the shale revolution’s international spread. However that will be, it is our view that the major long-term conclusions from our analysis remain unaltered even with oil prices persevering for many years at the 2015 levels. The main reasons are that shale oil is likely to remain broadly economic at those lower market prices, and that many producers will thrive in a low price environment as they are incentivized to slash costs and increase operational efficiencies.

The efforts to develop renewables for the purpose of climate stabilization will become more costly, requiring greater subsidies, in consequence of lower fossil prices

We firmly believe that the combined impact of the two revolutions will have an overwhelming impact on oil, by far the economically most important primary commodity in human use. The oil output increases alluded to above are bound to have a strong price-depressing impact, either by preventing price rises from the first-half 2015 levels, or by pushing them back to these levels if an early upward reaction takes place. Our reference case conclusion on prices envisages a level of about $60 in 2035, while a more optimistic scenario which appears increasingly likely, sees a price of $40 by then. The price implications of the revolutions will in turn influence many other conditions that shape human life, be they economic, political, diplomatic or military. This, however, is the subject of the book’s third part.

Part III. Global implications for the macroeconomy, the environment and for politics

The global spread of the revolutions and the ensuing price weakness that we envisage for the coming two decades will, on balance, provide a great advantage both to the oil industry and to the world economy at large. Successful shale and conventional oil developers could reap benefits similar to those bestowed on the US in its progress in recent years.

Not surprisingly, there would be important negative repercussions on public income from oil in producing/exporting nations that fail to compensate for the effects of the oil price decline by expanding output with the help of the revolutions. Juxtaposed against this conclusion is our supposition that the effects of the resource curse will be ameliorated as prices decline.

Geologically, the US does not stand out in terms of shale resources

The two revolutions will apparently cement and prolong the global fossil fuel dependence, with implications for climate policy. At the same time, the expansion and cheapening of natural gas in consequence of the revolutions will make it possible to shrink coal use in power production, thereby reducing CO2-emissions, as is already evident from the US experience since some years. The efforts to develop renewables for the purpose of climate stabilization, however, will become more costly, requiring greater subsidies, in consequence of lower fossil prices.

The abundance caused by the revolutions will lead to hard to fathom changes in international political relations. We assert that much of the oil importers’ urge for political intervention and control will dissipate as the criticality of access becomes less urgent with normalization of profit levels and more ample and diversified oil availability. For instance, the heavy diplomatic and military presence of the United States in the Middle East is likely to be questioned when the country’s dependence on oil from the region is further reduced. The growth and geographical diversification of supply would not only suppress prices, but would also promote competition among suppliers and make it more difficult for producers to influence the market to their advantage or for their governments to use energy sales in pursuit of political ends.

There is no doubt that successful shale and conventional revolutions will bring about exciting changes in many fields. Our book aims to explain what they are and where they will occur. However preliminary, we believe our findings will be highly useful as a starting point for discussions and analyses to follow in many coming years.

source: www.energypost.eu By Roberto F. Aguilera, Marian Radetzki, September 25th, 2015

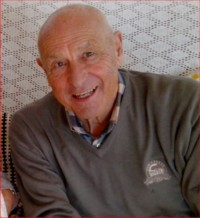

Roberto F. Aguilera is Adjunct research fellow at Curtin University, Australia. Marian Radetzki is Professor of Economics at Luleå University of Technology, Sweden.

Dig more: on the price of oil.

Mis en ligne le 25/09/2015  pratclif.com

pratclif.com

Although oil has experienced an extraordinary price increase over the past few decades, a turning point has now been reached where scarcity, uncertain supply and high prices will be replaced by abundance, undisturbed availability and suppressed price levels in the decades to come, write Roberto F. Aguilera of Curtin University in Australia and Marian Radetzki of Luleå University of Technology in Sweden. In this article they provide a synopsis of their new book, The Price of Oil, which is to be published by Cambridge University Press in October 2015. They explain why we are in a new oil price world and examine the implications of this turnaround for the world economy, as well as for politics, diplomacy, military interventions and the efforts to stabilize climate.

Although oil has experienced an extraordinary price increase over the past few decades, a turning point has now been reached where scarcity, uncertain supply and high prices will be replaced by abundance, undisturbed availability and suppressed price levels in the decades to come, write Roberto F. Aguilera of Curtin University in Australia and Marian Radetzki of Luleå University of Technology in Sweden. In this article they provide a synopsis of their new book, The Price of Oil, which is to be published by Cambridge University Press in October 2015. They explain why we are in a new oil price world and examine the implications of this turnaround for the world economy, as well as for politics, diplomacy, military interventions and the efforts to stabilize climate.