In this article, we will cover the following topics:

The current currency war: In order to understand this new episode in the currency wars we need to understand the major players with skin in this game. We can say that the three biggest players are the Euro, the Dollar and the Yuan. The Euro and the Dollar are both floating currencies, which means that their exchange rates are determined by the forces of supply and demand. However, the Yuan is a fixed currency, its value is pegged to that of the dollar. Let’s explain the different types of exchange rate systems in order to understand better the playfield of this current currency war.

The three major types of Foreign Exchange Rates are the following:

In this system the value of the currency is completely determined by the market forces. The value will change depending on the demand and supply of the particular currency. In plain words: the central banks or governments do not influence the currency value.

But what creates supply and demand? Imagine that you are an U.S. citizen and that your currency, the Dollar, is completely free-floating (remember is your imagination, not reality). Each foreign receipt to the U.S. will increase the demand for U.S. dollars and increase the supply of foreign currencies. These foreign receipts include, among others: exports, foreign investments, tourism, foreign debt obligations in dollars, and monetary gifts coming from other countries. The opposite case, in which a payment to some other country needs to be made, results in supply of dollars and demand for foreign currencies.

What type of payments? Imports, investments from U.S. citizens in other countries, foreign loan repayments, foreign travel… Speculators, Hedgers, and investors will also influence the exchange rates by their dealings in the FOREX markets.

Demand and supply, and their relationship to price, in the exchange rate markets are exactly the same as in any other market. Simplifying the relationship of supply and demand, and keeping any other variable constant, we know that if the demand of a computer goes up and the supply remains the same, the effect is an increase in the price of the computer.

Why? Imagine that in the initial scenario 20 people wanted to buy a computer, so the demand was 20, and the 20 were able to buy the computer at a price of X. Now, since other people saw how amazing computers are, 100 people want to buy a computer. If the company can only produce 20 computers, they could sell them to the 20 fastest guys price X, or they could increase the price until that point where only 20 people want the computer. What do you think companies, which motto is “profit, profit, profit!,” are going to do? Yes, you got it!

As we can see, higher demand with stagnant supply translates in higher prices. In the currency markets, instead of buying computers we are buying another currency. Now, imagine that the supply of euros remains the same (hard to imagine with the QE rolling!), if the demand of euros by Americans increase, because more Americans want to visit La Tour Eiffel, party in Barcelona, or because more people think that European equities are a better investment than U.S. equities, the price of euros is going to increase, which means that we are going to need more dollars to buy the same amount of euros. Now, I am sure you can imagine some other scenarios in which the opposite effect will occur.

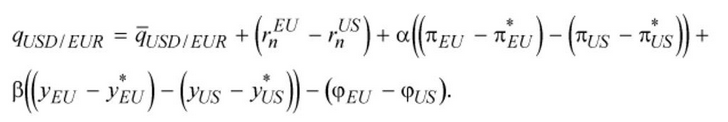

There are macroeconomic developments that can influence the demand and supply of foreign currencies. For example, inflation will increase the demand for foreign currencies because since the prices are higher in the domestic country, the nation will tend to import more. There is a beautiful formula that combines different theories such as uncovered interest rate parity, purchase power parity and the Taylor’s rule in order to explain the level of a particular currency pair. We got this particular one from the CFA curriculum, it is for the currency pair Euro Dollar.

where:

The exchange rate, depends on

The exchange rate, depends on

The long-run equilibrium rate

The long-run equilibrium rate

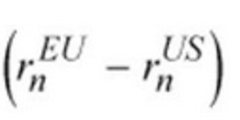

The interest rate differential

The interest rate differential

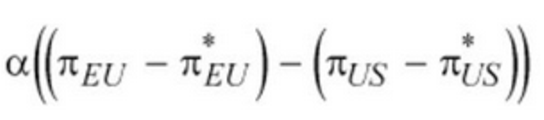

The inflation gap (not the same as inflationary gap) differential between the two countries. The inflation gap is the difference between the actual and the expected inflation levels.

The inflation gap (not the same as inflationary gap) differential between the two countries. The inflation gap is the difference between the actual and the expected inflation levels.

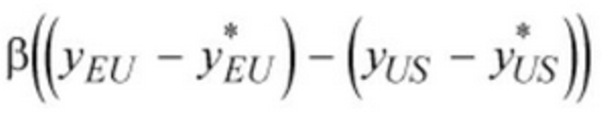

The output gap differential between the two countries

The output gap differential between the two countries

The risk premium differential. The risk premium is a value that represents how risky is to hold investments in a particular country. For example, holding Sierra Leona’s Leone is riskier than holding dollars and the risk premium factor will make sure that this is taken into consideration.

The risk premium differential. The risk premium is a value that represents how risky is to hold investments in a particular country. For example, holding Sierra Leona’s Leone is riskier than holding dollars and the risk premium factor will make sure that this is taken into consideration.

As a last though about free-floating exchange rate systems: in this type of regime when a currency gains value its called appreciation while when it losses value its called depreciation.

Due to the behavior of central banks in this XXI century, it is really hard to label any of the three major currencies, or any other currency for that matter, as a free-floating one.

In this type of regime the exchange rate is fixed by the government or a government related body, such as a central bank. In theory, the main purpose to have a fixed exchange rate system is to ensure the stability of the currency. The system is called fixed because the value of the currency is tied to the value of some particular standard, or to another currency. As you know, in recent history the main standard was gold. When the latter case exists, when the value of a currency is tied to another currency, the system is known as a currency peg.

Why countries peg their currencies to others? Some countries do it in order to decrease the volatility of their currencies. Countries that do not have a big presence in international trade or a lot of funds to protect their currencies can be subjects to higher volatility due to, for example, speculative attacks. However, some other countries keep pegs in order to maintain their competitive position in a trade partnership.

In a free-floating exchange rate between two countries, the one that exports more will see an appreciation of its currency vis a vis the importer country’s currency. Since the country that is importing needs to buy the currency from the exporter country, the higher demand of the exporting country’s currency will result in an appreciation of the exporting country’s currency. However, as the exporting country’s currency appreciate, the exports will increase in price and lose attractiveness. This will result in fewer imports by the foreign country.

How the exporting country can solve this situation? Well, by pegging its currency to the one of the importing country and by standing ready to defend the peg. I am sure that this arrangement reminds you to one between the most powerful Western country and the most powerful Eastern country… did someone say U.S. and China?

How can central banks keep the value of a currency pegged to the value of another currency? They perform what is known as currency interventions, or currency manipulations.

It has two major forms unsterilized intervention and sterilized intervention.

In this case the central bank buys, or sells, foreign currency securities using domestic currency that it issues. For example, the FED can buy euros and sell dollars, which puts a downward pressure in the dollar and depreciates it against the euro.

Sterilized Intervention – It is like an unsterilized intervention but with a twist in order not to change the monetary base (central banks would want to keep the same monetary base in order to not influence the inflation levels). The first stage is conducting an unsterilized intervention. After this, the central bank will turn around to the private sector and “sterilize” the effect of the intervention by either selling domestic currency securities (in the case that it bought foreign currency securities), or buying domestic currency securities (in the case that sold foreign currency securities). If the ECB wants to depreciate the euro but it is scared about inflation it will perform a sterilized intervention. The ECB will buy dollars with euros depreciating the value of the euro, but at the same time will sell euro denominated securities to private institutions in order to keep the same amount of money available.

In order to be able to perform these activities central banks need to have sufficient foreign currency reserves in order to stand ready to keep the value. For example, if the dollar was pegged to the euro at 2 dollars per euro, and the euro was seeing appreciation against the dollar, due to one of the reasons above-mentioned, the FED should be ready to sell euros and buy dollars in order to defend the value of its currency. However if it runs out of euro reserves, it will not be able to defend the peg.

If a particular fixed rate is unsustainable, the central bank can effectively change the peg by devaluating the currency. A devaluation will mean that the domestic currency will have a new pegged value that is lower than the previous one. The opposite term, revaluation, occurs when the peg is moved downwards, which means that the domestic currency gained value against the foreign one. These two terms contrast with the ones previously mentioned of appreciation and depreciation.

In a managed float system the currency still floats against other currencies. However, the monetary authorities will seek to increase or decrease the value of their currencies by performing the interventions previously mentioned or with more indirect methods.

There are some tools that central banks can use in order to influence the exchange rate, or to imitate the effects of a favorable move in the exchange rate, without really performing any operation in the foreign exchange market. These tools might have other purposes than just influence the exchange rate, however, the effect on the exchange rates cannot be forgotten. Among these actions we can find.

Import tariffs – A tariff on imports effectively produces the same effect than a currency depreciation. This is because the price of the imported good rises as it would rise if the domestic currency would drop in value. Since the price of the imported goods increase, the domestic consumers will turn to the domestic products.

Change in interest rates – The change in interest rates modifies the demand of the domestic currency by foreigners. When a central bank drops the interest rates the securities of that particular country offer a less attractive return so the exchange will suffer a depreciation. The opposite occurs when the central bank hikes interest rates.

QE – QE increases the supply of the domestic currency. When the supply is increased and the demand doesn’t change the price of the currency is going to drop. This is why when the market expects a central bank to start performing QE the currency will drop in value.

Note – Central banks and governments can also limit or prohibit the trading of their currency at any other level than its not the one set by them, however, this type of intervention is not that popular since its really negatively seen by the market players.

I think that most of the floating currencies are somewhere between free floating and managed. We cannot say that the ECB and the FED continuously manage their currency value, however, we can agree in the fact that they tend to influence the price of their respective currencies quite often.

Now that we have in mind how the past has been, and how the present looks like, in terms of exchange rates, I think we are prepared to discuss the current situation.

If you feel like you need to read the first post of the series again: Yuan Devaluation: Currency Wars Revisited. To move to the last post of the series – Yuan Devaluation: Currency Wars – part 3

Source: source: Opseeker – Contributing to financial literacy

Dig deeper

Mis en ligne le 01/08/2014 ![]() pratclif.com

pratclif.com