Oyu Tolgoi giant porphyry copper project in Mongolia's South Gobi region

This 14 January 2013, I was contacted by the British NGO "Raid" to give an opinion about Oyu Tolgoi giant porphyry copper project in Mongolia's South Gobi region [see contents of this mail]. The problem is that some politicians and NGOs in the country are pressing the Government to amend the terms of the mining agreement to increase its revenues. This short note is my response to RAID's request, having consulted documentation on line thanks to google search engine.

My knowledge of the copper and gold markets dates but many of the elements are still there, related to my professional involvement in some of the large porphyry copper mining projects in the world.

Since I was involved, the great change is the increased importance of copper (and gold) as an engine of world growth with China playing a major role in fueling this growth. The demand and price of copper is a significant indicator of world growth, an opportunity for capital investment and return on investment. A porphyry copper orebody (Oyu Tolgai central) to be exploited openpit first, with an underground extension when depth becomes to great, needs an enormous capital (US$6

billion), technical expertise and knowhow, that only a major mining company or - combination of majors (Turquoise Hill, Rio Tinto) - can provide. The full technical report is available on line [link pdf 536 pages], from which I have extracted these 2 pages on deposit types [link];

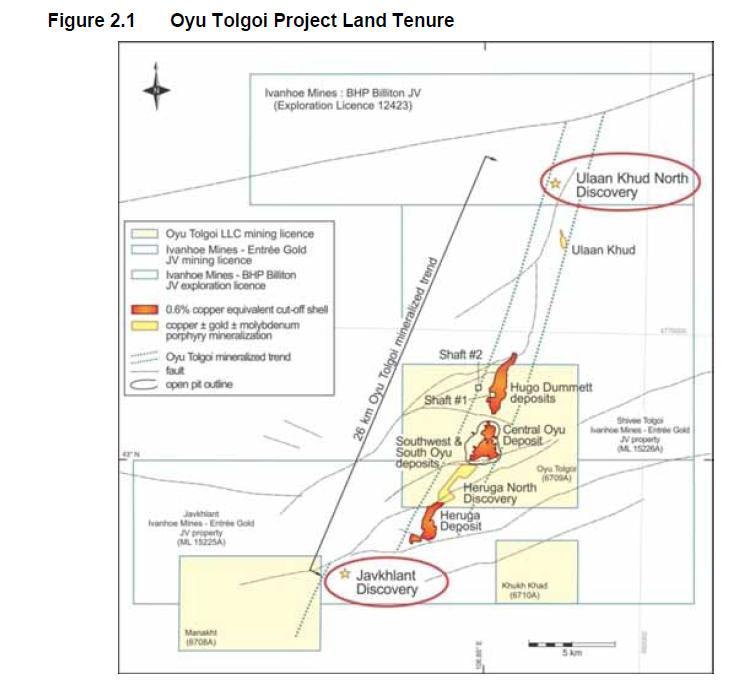

The orebodies are shown here (clik to enlarge):

Mining majors that can muster such large amounts of scarce capital and who have the expertise (*) to tap giant porphyry copper ore bodies that are also scarce in the world, have to be assured that their efforts and economic calculation will not be jeopardized by changes in government policy towards them. I understand that it took years for Turquoise Hill to reach a workable mining agreement. The clause that Government may increase its stake after 30 years was probably a sticky point. Thirty years is the time required for such a huge project with a total capital investment of US$13 billion to have yielded its NPWV [link].

.

(*) Which involves expert geological studies to ascertain reserves, then exploration and drilling, modelling, openpit and underground mining design, plant and equipment deployment; then ore beneficiation from ores containing typically 0.5% Cu to a concentrate grade of 32% Cu, which is the saleable product of the mine to a copper smelter; then tailings disposal, environmental constraints of which water availability, etc.

I understand Government of Mongolia is running a budget deficit, due to reasons which include public spending, insufficient taxing, temporary slowdown of economy in China, monetary expansion and so on... Some people want the Government to amend the mining agreement to increase the country's share of the profits, what they call "the country should control its mineral resources". This is Government intervention.

My view is that this should not be the method for obtaining more. Such government intervention would frighten foreign capital investors from coming for future developments. But this shouldn't be the end. As I indicated above, copper demand and prices are a major engine of world growth with China playing the main role in the region and a major commercial outlet for the mine and complex. The volatility of copper prices appears to me less than it was. And speculation reduces volatility for producers. Speculation is positive when it enables producers to pass on the risks of price volatility to other financial actors, ready to risk for gains and losses, and thence to concentrate on production.

Annual average production of the mine is 425kt Cu content (877.6Mlb) and 0.46Moz of gold [link]; the cost of production is projected to be in the first quartile of the cumulative cost/production curve ie 0.5US$/lb Cu (link).

The present anticipated long trend for copper is bearish [link]with market price in a range around 3.5US$/lb Cu [link]. Plus by products gold, silver and molybdenum which at the present prices [link] add significant value to production. So the value of production of copper has to account for by-products. Hence an equivalent value of production in lb Cue should be calculated to include gold, silver and molybdenum expressed in Cu equivalent. Hence royalties would apply to production in lb Cu equivalent ie. including by-products.

In addition, one could argue for modulating the royalty paid in US$/lb of Cu equivalent produced, based on a formula having Cu, Au, Ag, Mo, market prices in it, taken from LME statistics or any other accepted institution. Of course Government of Mongolia is sovereign and could exercise coercion with consequences both visible (obtaining what they want) and invisible (long term impact on foreign investment that is useful to them and world economy); they should only exercise this as a mean of pressure to entice Turquoise Hill to accept royalty paid on Cu equivalent production and its modulation with world market prices of Cu, Au and Ag on a multi year time basis.

From documents available on Turquoise Hill's website [link], I understand that the Government is not envisaging to amend the mining agreement; but a consensus has been reached to discuss and clarify certain clauses of the agreement to ensure mutually beneficial rights to both parties. This may be a clue to a solution based on clarifying royalties (also apparent here).

In addition to the discussion on certain clauses of the mining agreement, with regard to increasing revenues for Mongolia, there is growing concern about the ESIA (environmental and social impact assessment): see this report by Oyu Tolgoi Watch: "A useless sham" A Review of the Oyu Tolgoi Copper/Gold Mine Environmental and Social Impact Assessment (link). Construction of the mine has been going on since 2010 and is almost completed with operations due to commence, whereas the ESIA was released in August 2012 as required by the IFC and the EBRD for projects of this nature, after eight months of delay. Moreover, as the report of Oyu Tolgoi Watch shows, some very critical issues have not been addressed correctly, such as water supply from the fossil aquifer, wet tailings disposal, and relocation of indigenous populations. Oyu Tolgoi Watch argue that this in violation of IFC's guidelines for ESIAs.

- Raid's mail and request Turquoise Hill web site

- Turquoise Hill on twitter

- Oyu Tolgoi web site

- Oyu Tolgoi on twitter

- Oyu Tolgoi on facebook

- Photos

- SAG mills semiautogenous grinding mills; crucial equipement for ore beneficiation

- porphyry copper

- Rio tinto turquoise hill google search

- Turquoise Hill Resources | wikipedia

- Rio Tinto to Oyu Tolgoi mine: Let there be light

- The debate on renegotiating the mining agreement

- Investor Presentations and Briefings

- Turquoise Hill Investor Presentation, December 10, 2012

- IFC's presentation to the board of the WB for financing

This presentation is no more than Turquoise Hill's own presentation to investors made in December 2012 - Full technical and economic report

- Extract of the above for the economic evaluation

- OT Watch: report on the ESIA environmental and social impact assessment "A useless sham"

- Mongolia wikipedia

- Mongolia google search

- Mongolia CIA

- Mongolia world bank

- Mongolia United Nations